[ad_1]

On June 23, 2023, Robert B. Bruce (1931-2023) handed away. It diminishes a wealthy life and beneficiant soul to explain him merely as “one of many portfolio managers of the Bruce Fund.” A Wisconsin graduate, he had a long-time friendship with Ab Nicholas, one other famend investor, and namesake of the Nicholas Fund, with whom he created an endowment for Wisconsin athletics. His obituary celebrates “a mannequin of onerous work, generosity, and unpretentious success” who handed away “within the embrace of his household.” From 1965-1972, Bob helped handle the Mathers Fund (MATRX) to phenomenal success, then set out on his personal in 1972. He finally bought a small mutual fund in 1983, introduced on his eldest son, Jeff, as accomplice and co-manager, and crafted a 40-year file of distinction and success.

On June 23, 2023, Robert B. Bruce (1931-2023) handed away. It diminishes a wealthy life and beneficiant soul to explain him merely as “one of many portfolio managers of the Bruce Fund.” A Wisconsin graduate, he had a long-time friendship with Ab Nicholas, one other famend investor, and namesake of the Nicholas Fund, with whom he created an endowment for Wisconsin athletics. His obituary celebrates “a mannequin of onerous work, generosity, and unpretentious success” who handed away “within the embrace of his household.” From 1965-1972, Bob helped handle the Mathers Fund (MATRX) to phenomenal success, then set out on his personal in 1972. He finally bought a small mutual fund in 1983, introduced on his eldest son, Jeff, as accomplice and co-manager, and crafted a 40-year file of distinction and success.

However what now? What’s to be manufactured from Bruce (the fund) after Bruce (the founder)?

Good query! Our Could 2020 profile of the fund provided this Backside Line:

Bruce is an enigmatic fund as a result of its managers select for it to be so. They don’t clarify themselves to the general public, although they do reply calls from their buyers. They don’t have “a method,” don’t depend on rigorous quantitative evaluation, and don’t have “a deep bench” behind them. They do, as far as I can inform, discuss to a number of contacts and business insiders to maintain a transparent view of the place dangers and alternatives lie. They do keep constantly low portfolio turnover whereas nonetheless shifting when the chance set arises.

The 2 cautions concerning the fund are (1) the elder Mr. Bruce’s age and the implication of shifting from a two-person group to a single supervisor with no accomplice and (2) the insensitivity of the portfolio to the sustainability, in an ESG sense, of the portfolio’s holdings.

That mentioned, it’s onerous to think about why an independent-minded investor wouldn’t have the fund on their due-diligence listing.

Now that the primary has come to cross, what’s an investor within the $500 million fund to do? That stirred a wholesome dialog on the MFO dialogue board and a name to supervisor Jeff Bruce.

The worst-case final result is a replay of the destiny of the Mathers Fund. Thomas Mathers (1914-2007) was an acerbic “go-go development supervisor with an iron abdomen.” He launched Mathers Fund in 1965 with three co-managers. It had a gradual begin, then took off, excelling in each bull and bear markets. Mr. Bruce left in 1972, and Mr. Mathers, in a transfer he got here to remorse, handed the fund off to Henry Van der Eb in 1974 and bought the advisor to him in 1981. Mr. Van der Eb describes himself as “a dyed-in-the-wool worth man.” Others possible would have mentioned, “perma-bear.” There’s little query that Mr. Mathers would have described him as “my largest mistake.” Beneath Mr. Van der Eb, Mathers reworked right into a stock-light bear fund that so infuriated Mr. Mathers that he demanded that his title be taken off the fund. Mr. Van der Eb refused. Property withered. Gabelli/GAMCO purchased the fund in 1999 after a decade by which the fund trailed the S&P 500 by 18% to three% and additionally trailed the typical cash market. Mr. Van der Eb selected to shut the fund in 2018. Chuck Jaffe provided this obituary:

In line with Mathers’ personal annual report on the finish of 2017, a $10,000 funding within the fund made when it opened in 1965 was price $195,153 by Dec. 31, 2017; the identical quantity invested within the S&P 500 was price $1.48 million.

In brief, on the five-decade scale from one to catastrophe, Mathers Fund is a monetary Chernobyl, a nuclear wreck.

Chuck at all times had a means with phrases.

Mathers is the worst-case final result: an distinctive fund reversing course, changing into one thing completely new (and alien), struggling collapsing returns and hovering bills. However it’s not the template for supervisor modifications in eponymous funds; that’s, funds bearing the title of their founding supervisor(s). In some instances, the transition is totally seamless: the Mairs and Energy funds, specialists in investing with distinctive care within the US Midwest, have managed 4 units of supervisor successions with no hiccup; every of their 4 funds carries a four-star designation from Morningstar.

In different instances, the transition is clouded by exterior components. The Fasciano Fund was the highest small cap fund of the Nineties on each an absolute return and risk-adjusted return foundation. It was Michael Fasciano’s automobile, and he drove it nicely. The capsule is that Michael is the form of supervisor that T. Rowe Worth loves: the smart, disciplined, constant man who wins by hitting for common quite than for energy and who not often strikes out. And but, Fasciano isn’t any extra. We detailed the story of the rise and fall of one in all our favourite small cap funds, however the brief model is the fund soared, Michael partnered with Neuberger-Berman for assist, Neuberger acquired purchased by Lehman Brothers shortly earlier than their cataclysmic failure, and in a determined try to remain afloat, Lehman ordered hundreds of layoffs. Mr. Fasciano was amongst them, and his fund was merged out of existence.

Our colleague Ed Studzinski’s query for such funds was at all times the identical: “Sure, however what if the supervisor will get hit by a bus tomorrow? What are their shareholders to do?”

The brief reply: absent an apparent purple flag, relax. You’ll be fantastic.

To achieve that conclusion, we appeared on the efficiency of a handful of well-known eponymous funds following their founders’ departure, whether or not via retirement, dying, or dismissal. In just about all instances, funds flourished – not less than when it comes to persevering with their conventional risk-adjusted efficiency – within the years instantly following their founders’ departure. Right here’s what we discovered.

Nicholas with out Nicholas, seven years

Albert “Ab” Nicholas, an previous pal of Robert Bruce’s, handed away in August 2016 on the age of 85. He was, together with his son David, co-manager of Nicholas Fund till his final days. Nicholas Fund was launched in 1969, with son David Nicholas becoming a member of as co-manager in 2011. With Mr. Nicholas’ passing, Michael Shelton was elevated to co-manager. Jeff Sturdy joined the group final 12 months.

Nicholas is a four-star fund with $3.6 billion in property. It’s characterised as a large-growth fund with a smattering of mid-cap names. We spoke in July 2023 with Larry Pavelec, COO and Govt Vice President of the adviser, about their expertise managing in Mr. Nicholas’ wake.

Each agency is completely different. Ab’s passing gave us the chance for a deep reset and self-analysis. Ab was skeptical of tech and most well-liked backdoor tech, whereas Dave Nicholas has grown up with a higher consolation degree with expertise as central to our lives, and he acknowledges corporations like Microsoft and Apple as free cash-flow machines. We’re additionally in all probability extra cap acutely aware than earlier than as a result of our buyers want it. Ab was a go-anywhere man who would possibly transfer the fund to worth. And we’re somewhat extra open to advertising, although we’re delicate to the problem of getting an excessive amount of noise within the system.

David has labored with Ab on this technique for 30+ years. The one factor that didn’t change was the philosophy that we observe. We attempt to be disciplined. Consider within the philosophy. We put our shoppers first. We search to spend money on corporations with sustainable benefits, however we accomplish that with a strict valuation self-discipline. And we proceed to look to enhance, to adapt to the markets.

Within the seven years for the reason that elder Mr. Nicholas’ departure, the fund has modestly outperformed its friends in complete returns. Whereas its most drawdown and normal deviation match its peer group, it outperforms by measures of draw back deviation, bear market deviation, and risk-adjusted returns.

Submit Nicholas Efficiency

|

APR |

MAXDD |

STDEV |

DSDEV |

BMDEV |

Sharpe Ratio |

Ulcer Index |

|

|

Nicholas |

12.8 |

-24.4 |

16.1 |

10.5 |

10 |

0.71 |

7.4 |

|

Giant-Cap Core Common |

12.4 |

-24.3 |

16.1 |

10.7 |

10.2 |

0.68 |

7.7 |

Supply: MFO Premium. Inexperienced fill alerts the outperformance of its benchmark for the interval for the reason that transition. MFO Premium makes use of a distinct color-coding system in its rankings. A fund’s Lipper peer group ceaselessly differs from its Morningstar peer group, which can account for divergent relative efficiency.

Yacktman with out Yacktman, seven years

There are days when it appears just like the Yacktman funds are simply toying with the remainder of us. Yacktman seems in additional articles about excellent investments at MFO than every other fund or agency.

Don Yacktman performs lots like a personality out of “Depart It To Beaver.” Quiet, self-effacing household man. Boy Scout. Religious Mormon who sang within the choir. Quietly principled: he shrugged off the Nineties when the dot-com market practically wrecked his agency, then shrugged off the 2000s once they effortlessly doubled the S&P 500. He left his earlier agency, the place his fund was performing brilliantly, as a result of they have been getting “sleazy” (Pat Regnier, “Don Yacktman’s Lonely Campaign,” Cash, 4/1/1999, a fantastic story there).

His rationalization for the right way to win in investing is straightforward:

He waits to purchase nice corporations once they’re down and rides them till they get better, which nice corporations virtually at all times do. You don’t want to leap out and in of shares, he tells them. “You simply have to catch the wind sufficient occasions,” he says. “And you must be very, very affected person.” (“Don Yacktman: A fund supervisor’s religion produces outcomes,” Fortune, 12/13/2012).

“Being affected person” interprets to a willingness to carry money, typically various money, for fairly a very long time till the market presents – as it will definitely does – appropriate alternatives. That always means struggling horrible relative returns when the market is frothy (trailing 90% of their friends in 2019 and 2021 whereas nonetheless making 18% per 12 months for his or her buyers) and crushing when the markets flip uneven (as in 2018 and 2020).

Don Yacktman based Yacktman Asset Administration in 1992, the 12 months he launched Yacktman Fund. 5 years later, he added Yacktman Targeted. Earlier than founding the agency in 1992, he managed Chosen American Shares (SLADX) for practically a decade and was named Fund Supervisor of the Yr by Morningstar in 1991. Don Yacktman stepped apart as CEO of Yacktman on August 1, 2013, and as portfolio supervisor in 2016. From launch via mid-2016, $10,000 in Yacktman grew to $104,000. The identical funding within the S&P 500 grew to $81,000. Stephen Yacktman is now the lead supervisor of the Yacktman Funds. (Parenthetically, brother Brian Yacktman left in 2007 to launch the YCG Enhanced Fund (YCGEX), which has, over the previous seven years, greater returns than each the Yacktman funds and its peer group.)

Submit Yacktman Efficiency, 07/2016 – 06/2023

|

APR |

MAXDD |

STDEV |

DSDEV |

BMDEV |

Sharpe Ratio |

Ulcer Index |

|

|

AMG Yacktman |

10.6 |

-21.7 |

13.9 |

9.1 |

8.4 |

0.66 |

5.0 |

|

AMG Yacktman Targeted |

10.9 |

-21.0 |

14.3 |

9.2 |

8.6 |

0.66 |

5.2 |

|

Multi-Cap Worth Common |

9.5 |

-27.9 |

17.4 |

11.9 |

11.1 |

0.47 |

7.3 |

Supply: MFO Premium. See the earlier notice regarding cell shading and peer teams.

Cook dinner and Bynum with out Bynum, 5 years

Messrs. Richard Cook dinner and Dowe Bynum are concentrated worth buyers within the custom of Buffett and Munger. They’ve been investing since earlier than they have been teenagers and even tried to start out a mutual fund with $200,000 in seed cash whereas they have been in faculty. Inside a couple of years after graduating faculty, they started managing cash professionally, Cook dinner with a hedge fund and Bynum at Goldman Sachs. By their mid-30s, they have been managing an ultra-concentrated five-star fund headquartered in Birmingham, Alabama. Valuing their independence, they needed to work removed from the Wall Avenue crowd.

Dowe Bynum (1978-2020) handed away on Friday, July 17, 2020, at peace and surrounded by family members. Dowe, who eschewed his given first title, “Jasper,” was identified with mind most cancers about three years earlier than. Richard Cook dinner has been largely chargeable for the day-to-day administration of the portfolio since that point. Dowe’s sickness deeply affected his household, his pal and accomplice, and their agency.

Dowe Bynum (1978-2020) handed away on Friday, July 17, 2020, at peace and surrounded by family members. Dowe, who eschewed his given first title, “Jasper,” was identified with mind most cancers about three years earlier than. Richard Cook dinner has been largely chargeable for the day-to-day administration of the portfolio since that point. Dowe’s sickness deeply affected his household, his pal and accomplice, and their agency.

The fund, which regularly invested in simply six or seven shares, typically concentrated in Latin America and amongst mushy drink bottlers and distributors, is about unattainable to benchmark. Lipper calls it a “international multi-cap worth,” Morningstar had categorized it as a “world inventory” earlier than shifting it to “rising markets” not too long ago. It’s, as an EM fairness fund, a five-star performer.

The impact of Dowe’s absence is unattainable to gauge from the surface. The fund was a top-tier performer for its first 5 years, and cash poured in; with no change in self-discipline however a considerable change in market circumstances, it was a bottom-tier performer for the three years previous and following Dowe’s analysis. Probably a misfit in its new “diversified EM” dwelling, with 60% of its 9 inventory portfolio in Mexico and Chile, it has soared.

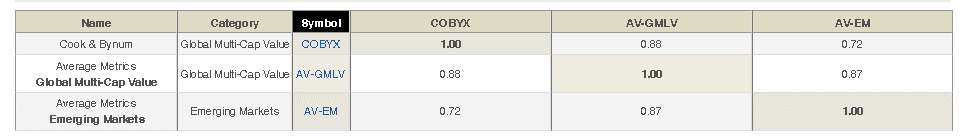

Morningstar categorizes COBYX as an rising markets fairness fund. Lipper locations it within the international multi-cap worth group, which is dominated by bigger corporations in developed markets.

We generated a five-year correlation matrix at MFO Premium, matching COBYX with its two potential peer teams.

The curious discovering isn’t that COBYX correlates extra with multi-cap worth than with rising markets (0.88 versus 0.72); it’s that COBYX has an almost an identical correlation with multi-cap worth as does the typical rising markets fund (0.88 versus 0.87).

The fund’s relative efficiency relies upon completely on which of these teams strikes you as most believable.

Submit Bynum Efficiency, 07/ 2018 – 06 / 2023

|

APR |

MAXDD |

STDEV |

DSDEV |

BMDEV |

Sharpe Ratio |

Ulcer Index |

|

|

Cook dinner & Bynum |

3.4 |

-26.9 |

16.6 |

11.8 |

11.1 |

0.11 |

11.2 |

|

Rising Markets Fairness |

0.3 |

-38.7 |

21.1 |

16.2 |

12.3 |

-0.02 |

16.8 |

|

International Multi-Cap Worth |

5.7 |

-27.4 |

18.7 |

13.1 |

12.2 |

0.22 |

9.8 |

Supply: MFO Premium. See the earlier notice regarding cell shading and peer teams.

Muhlenkamp with out Muhlenkamp, 4 years

Ron Muhlenkamp started his investing profession in 1968, launched Muhlenkamp Fund in 1988, and managed it from simply north of Pittsburgh, my hometown, which at all times made it a favourite. Ron was beloved by the CNBC-type discuss reveals for his readability and unshakeable confidence. By means of the Nineties and early years of this century, he clubbed the S&P 500, famously asking of the 2000-01 market collapse, “bear market? What bear market?” He would quickly discover a solution, because the fund trailed its Lipper friends in 11 of the following 14 years as Ron railed towards Fed coverage and rate of interest madness. I bought my very own stake within the fund after I concluded that Ron had developed an unhealthy ardour for reprinting his personal previous essays (“I advised you this was going to occur!”) whereas the fund floundered. The fund was underwater for 4 years (2007, 2011, 2015, 2016), whereas the S&P 500 made cash throughout that stretch.

He was joined by his son Jeff Muhlenkamp in November 2013. Son Todd serves as Muhlenkamp’s president. In February 2019, Ron handed over the day-to-day inventory selecting and portfolio administration duties to Jeff. Ron stays engaged with the agency. Because the handover, the fund has rebounded. The newest shareholder letter combines smart market projections from Jeff with flat-out foolish recommendation from Ron on the right way to get wealthy: “Simply save 50% of all of your cash,” primarily based on a decades-old reflection by Sir John Templeton on what labored for him after his commencement from Oxford (and assumption of a Wall Avenue job) within the Thirties.

Submit Muhlenkamp Efficiency, o7/ 2019 – 06 / 2023

|

APR |

MAXDD |

STDEV |

DSDEV |

BMDEV |

Sharpe Ratio |

Ulcer Index |

|

|

Muhlenkamp |

14.6 |

-27 |

17.9 |

11.8 |

11.3 |

0.74 |

5.9 |

|

Multi-Cap Worth |

8.8 |

-27.8 |

20.3 |

13.8 |

12.9 |

0.37 |

8.9 |

Supply: MFO Premium. See the earlier notice regarding cell shading and peer teams.

Akre with out Akre, 2.5 years

Akre Focus was born out of betrayal. Chuck Akre was the star supervisor of FBR Focus when FBR (Friedman, Billings, Ramsey & Co.) determined that he was being overpaid and provided a contract with a 50% price discount. Mr. Akre disagreed, mentioned one thing like “poop on you,” left together with his group of analysts, and launched Akre Focus in 2009. Solely to find, upon coming back from an out-of-town journey, that FBR had purchased his group away from him. Incensed, he employed and skilled new analysts. Within the years following, he clubbed the market and, measured by asset flows, clubbed FBR. Akre Focus reached $14 billion and five-star standing.

Akre Focus was born out of betrayal. Chuck Akre was the star supervisor of FBR Focus when FBR (Friedman, Billings, Ramsey & Co.) determined that he was being overpaid and provided a contract with a 50% price discount. Mr. Akre disagreed, mentioned one thing like “poop on you,” left together with his group of analysts, and launched Akre Focus in 2009. Solely to find, upon coming back from an out-of-town journey, that FBR had purchased his group away from him. Incensed, he employed and skilled new analysts. Within the years following, he clubbed the market and, measured by asset flows, clubbed FBR. Akre Focus reached $14 billion and five-star standing.

Mr. Akre stepped apart from day-to-day administration in December 2020, although he stays energetic on the agency. His most up-to-date actions encompass the buy of Eldon Farms as a “conservation buy” in 2021. Akre Focus is now managed by John Neff and Chris Cerrone. Mr. Neff is a Associate at Akre Capital Administration and has served as portfolio supervisor of the fund since August 2014, initially with founder Chuck Akre. Earlier than becoming a member of Akre, he served for ten years as an fairness analyst at William Blair & Firm. Mr. Cerrone, a Associate at Akre Capital Administration, has served as portfolio supervisor of the fund since January 2020. Earlier than that, he served as an fairness analyst for Goldman Sachs for 2 years.

The fund has seen substantial outflows following Mr. Akre’s departure. Efficiency in 2021 and 2022 was considerably above common, whereas 2023 (via July) is strong in absolute phrases and lackluster in relative phrases.

Submit Akre Efficiency, o1/ 2021 – 06 / 2023

|

APR |

MAXDD |

STDEV |

DSDEV |

BMDEV |

Sharpe Ratio |

Ulcer Index |

|

|

Akre Focus |

4.2 |

-29.3 |

20.9 |

14.3 |

12.4 |

0.11 |

14.3 |

|

Multi-Cap Progress |

-2 |

-36.7 |

22.2 |

16.5 |

15.2 |

-0.13 |

21.5 |

Supply: MFO Premium. See the earlier notice regarding cell shading and peer teams.

Walthausen with out Walthausen, two years

Walthausen & Co., LLC. was an employee-owned funding adviser that John Walthausen based in 2007 after working the Paradigm Worth Fund. It specialised in small- and mid-cap worth investing. In September 2007, he was joined by your entire funding group that had labored beforehand with him at Paradigm Capital Administration, together with an assistant portfolio supervisor, two analysts, and a head dealer. John Walthausen retired on July 30, 2021, at age 75, after 14 years on the helm. Gerry Heffernan had co-managed the Fund since March 2018 and was joined by DeForest Hinman. Mr. Walthausen declared, “I’m assured that Gerry, DeForest, and the remainder of the group will carry the agency far into the long run.”

Buyers expressed much less confidence. Property in December 2021 have been $100 million; property in December 2022 dropped to $36 million, pushed, as far as we will inform, by institutional redemption. The Board of Trustees concluded that they wanted to promote the fund to North Star Funding Administration Company in December 2022.

NorthStar put in the group that’s additionally chargeable for NorthStar MicroCap. The fund was respectable in 2022 and has lagged 80% of its friends for the reason that North Star transition (via July 30, 2023).

Submit Walthausen Efficiency, o7/ 2021 – 06 / 2023

|

APR |

MAXDD |

STDEV |

DSDEV |

BMDEV |

Sharpe Ratio |

Ulcer Index |

|

|

North Star Small Cap Worth |

-0.7 |

-20.1 |

21.2 |

13.3 |

11.7 |

-0.13 |

9.4 |

|

Small-Cap Core |

-2.9 |

-22.7 |

21 |

14.5 |

13.1 |

-0.24 |

11.6 |

Supply: MFO Premium. See the earlier notice regarding cell shading and peer teams.

Bruce with out Bruce, one month

And Bruce? The Youthful Mr. Bruce will persevere, I think. His dad was increasingly more a voice within the background, I think. Our profile famous, “They don’t clarify themselves to the general public, although they do reply calls from their buyers.” Actually, I known as the fund (they don’t publish an e-mail handle); Jeff Bruce answered on the second ring, and I talked to Jeff Bruce for about 20 minutes. He’s very nice and agreeable however has spent 38 years with the mantra: we discuss to our shareholders, not the outsiders.” No interviews with Morningstar for the reason that early 80s, when Mr. Mansueto was a two-person operation and a e-newsletter. (The youthful Mr. Bruce went to highschool with Mr. Mansueto, however they appeared to not be in the identical social circle.)

The takeaway is that Jeff anticipates no change. He and his dad labored collectively for 38 years. They talked about every thought. If one in all them favored it, they purchased somewhat. If each of them favored it, they purchased lots. And vice versa with gross sales. The assist group stays in place, and confidence is unshaken.

He does know that we’ve commented favorably on the fund’s excessive money stake. (Presently, 25% with substantial overweights in defensive shares.) He appears to understand the understanding. The fund is underwater at the moment, largely as a result of they’d anticipated a tough market. It’s, he studies, their fifth-worst efficiency since launch. He admits that there’s considerably restricted consolation within the remark, “nicely, we have performed worse 4 different occasions and at all times bounced again by sticking with the plan.”

It’s completely cool that the supervisor, of their 450 square-foot world headquarters, solutions the cellphone himself on the second ring, and enjoys speaking with shareholders. Since a one-month efficiency desk is foolish, we gained’t waste your time.

Backside Line

The proof is constant, although our survey isn’t encyclopedic. In virtually all cases, funds carry out credibly within the years (two to seven, in our survey) following the departure of their founding supervisor. They could or won’t attain the heights of excellence seen underneath The Nice Man’s steerage, however they don’t betray their shareholders.

That’s a broad generalization. Your outcomes would possibly differ. If that prospect unnerves you, contemplate one in all two alternate paths. One prudent course for energetic buyers is normally a practical group or a agency (T Rowe Worth, Mairs & Energy) with a superb file for supervisor substitute. The prudent course for skeptics is likely to be a passive technique that’s not purely market-cap or debt weighted.

[ad_2]