[ad_1]

I’m within the ultimate levels of shifting workplace and it has been a time consuming course of. And one among my common analysis colleague, Professor Scott Baum from Griffith College, who occassionally gives weblog posts right here, despatched me some analysis which he had written up in weblog submit kind and with time quick immediately, right here is Scott’s newest visitor spot. At the moment he’s going to speak a few new evaluation of monetary insecurity that we’re at the moment doing.

So in Scott’s phrases …

Regardless of what the neo-liberals suppose, there isn’t any monetary buffer for a lot of Australian communities

Over the previous 12 months or so, the neo-liberals have been eager on telling us that because of the restrictions imposed through the peak of the COVID-19 pandemic, Australian households constructed up a major monetary buffer largely within the type of financial savings deposits.

When the Reserve Financial institution of Australia (RBA) started jacking up rates of interest, the RBA Board claimed (Supply):

Some households had substantial financial savings buffers … households can be keen to scale back present saving charges or draw down on further financial savings amassed through the pandemic to cushion consumption from the results of declining actual incomes; these amassed buffers represented a bigger share of family revenue in Australia than these remaining in lots of economies.

An identical message was shared in an article printed within the RBA Bulletin (June 16, 2022) – Family Liquidity Buffers and Monetary Stress:

The ratio of family liquid belongings to family revenue in Australia has elevated considerably over latest many years, at each the mixture and particular person family ranges. The rise in buffers has been most pronounced for households with mortgage debt and amongst indebted households – with these with probably the most debt sometimes holding the best liquidity buffers. That is essential from a monetary stability perspective as liquidity buffers enable households to clean their spending and keep their debt fee obligations within the occasion of opposed shocks to their money flows; as such, they’re a key think about lowering family monetary stress.

So the RBA was making an attempt to inform us to not fear about rising costs, housing prices and different issues as a result of all of us can simply use our saving buffers.

In combination, this all sounds advantageous.

However aggregates are problematic.

They conceal the numerous heterogeneity in social and financial outcomes.

Contemplate the outcomes from surveys similar to this – Taking the Pulse of the Nation report (printed Might 2023).

The Report states that:

Regardless of higher employment, Australians proceed to face growing prices, leading to scarcity of funding to cowl primary wants similar to meals, housing, and well being expenditures. Vulnerability has not decreased prior to now six months. Treating consuming sufficient, consuming nutritious meals, potential to pay utility payments, and addressing well being wants as 4 separate challenges that results in monetary vulnerability, 15 p.c of the inhabitants reported one problem and 34 p.c of the inhabitants reported two or extra of those challenges.

And that:

Over the previous six months (August 2022 to February 2023), monetary stress has elevated barely. At the moment, greater than half (53 p.c) of Australians report simply making ends meet or worse.

So regardless of the aggregates spruiked by many, there are a major variety of individuals affected by monetary stress who’re at risk of falling by way of the cracks.

Monetary insecurity …coming to a suburb close to you!

In one of many topics I at the moment train, we regularly have wide-ranging discussions about how present social points are performed out throughout totally different cities and communities.

Not surprisingly, given the present state of play, my college students usually flip to the topic of the price of residing and monetary (in)safety, particularly as lots of them reside away from residence for the primary time or have moved to Australia from abroad and try to eke out an existence with little monetary backing.

The subject of monetary insecurity was becoming, given the scholars are at the moment specializing in problems with social and financial drawback, and it was attention-grabbing to see them unpacking among the points.

Following on from the classroom dialogue, I made a decision to experiment with a measure of monetary insecurity to enhance the opposite indices that Invoice and I’ve labored on over time.

For these , our – Employment Vulnerability Index – and the – Index of Prosperity and Misery in Australian Localities – measure employment vulnerability and financial prosperity on the degree of a Statistical Space 2 (SA2), and you may discover the information through the hyperlinks.

In main cities, SA2s are akin to suburbs or different massive communities, in order that they make a superb degree of aggregation to work with.

The thought was to develop an index that identifies the geographic distribution of monetary insecurity throughout suburbs and different locations.

We’ll launch an in-depth report in the end, however the preliminary scan of the outcomes exhibits some attention-grabbing outcomes.

The index borrows concepts from a 2022 analysis article – A Multidimensional Method to Measuring Financial Insecurity: The Case of Chile – which was printed within the journal Social Indicators Analysis and focuses on creating methods of measuring financial insecurity.

The writer defines monetary insecurity as:

The opposed well-being impact of involuntary publicity to uncertainty in enduring an uninsured monetary shortfall.

The writer additionally notes that:

The thought behind it’s that financial insecurity has a subjective element and is a forward-looking measure since stress and nervousness are related to monetary uncertainty.

They counsel that monetary insecurity might be measured by accounting for 2 dimensions:

The primary dimension is the danger of the family experiencing potential occasions associated to damaging financial penalties similar to unemployment, losses in asset values, or surprising medical bills …

The second dimension is the shortage of family financial buffers, which generates stress similar to not having sufficient belongings to face an occasion that decreases incomes or will increase bills, or not getting access to social safety mechanisms to offset these financial losses.

There’s an attention-grabbing assortment of information obtainable, with the minimal necessities being:

- Being an affordable measure or proxy of one of many dimensions and

- Being obtainable at a usable combination spatial degree.

The primary dimension might be measured by the share of individuals in an SA2 who derive their revenue from authorities funds or the share of households categorised as going through mortgage or rental stress.

The second dimension might be measured by contemplating the greenback quantity of per individual financial institution curiosity obtained and the quantity of dividend revenue obtained, the per individual wage and wage, the share of people that say they will’t afford an evening out, and the share of people that should not have entry to emergency funds.

The principle take-home from the preliminary first-cut evaluation is monetary insecurity is closely concentrated in communities which are extremely deprived.

No surprises right here.

As common, these struggling probably the most in social and financial phrases proceed to be screwed.

However it isn’t solely probably the most deprived who’re underneath the pump.

The evaluation additionally exhibits that there’s one other tier of locations which are categorised as struggling excessive monetary insecurity.

These locations will not be these usually thought of as going through severe drawback however given their degree of monetary insecurity, are locations more likely to be going through mounting strain.

A caveat to the analysis is that the information doesn’t account for the latest interval of utmost worth rises so we will think about that the place of each teams of locations has been magnified.

The outcomes for Sydney (Australia) present a superb illustration.

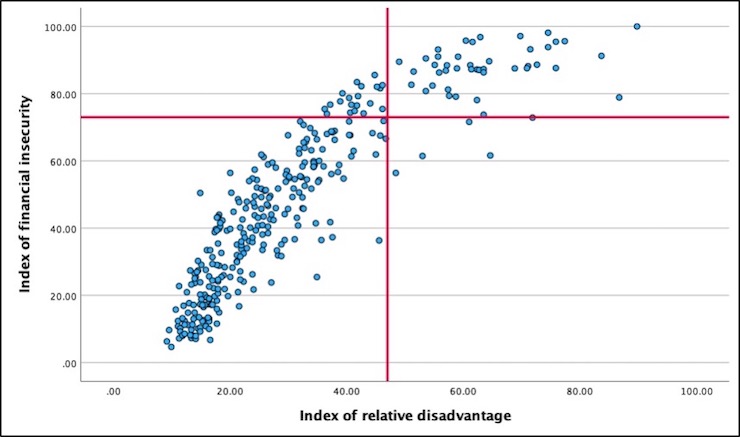

If we evaluate the end result of our monetary insecurity index and the Australian Bureau of Statistics SEIFA index of relative drawback, we will see some patterns emerge.

The scatterplot represents SA2s at varied factors on a high-to-low continuum with these above the road on the y-axis representing probably the most monetary insecurity and people to the precise of the road on the x-axis representing most relative drawback.

Quadrant two represents the group of SA2s with each excessive relative drawback and excessive monetary insecurity. Quadrant 1 represents these SA2s which, whereas not among the many most deprived, are nonetheless counted amongst locations affected by excessive ranges of monetary insecurity.

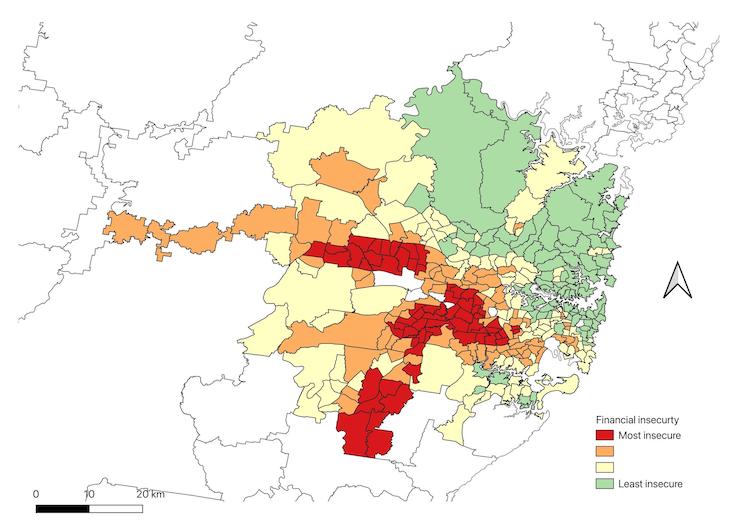

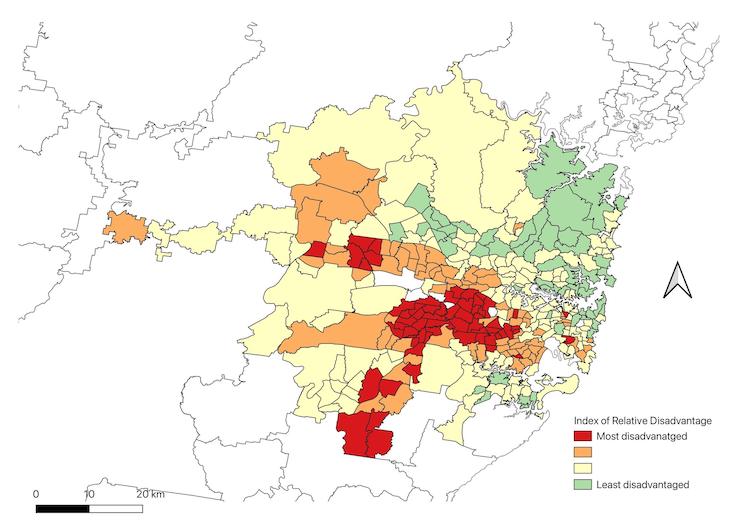

The 2 maps illustrate the spatial distribution throughout Sydney of the 2 measures.

The primary is the measure of monetary insecurity, whereas the seonc is the ABS SEIFA measure.

The distributions are comparatively clear.

Clusters (or hot-spots) of SA2s within the west and southwest of the town are categorised as being extremely deprived, and bigger clusters of locations in the identical areas are categorised as struggling excessive ranges of monetary insecurity.

Monetary insecurity: Yet another facet of neighborhood demise

Monetary insecurity is a gauge of future neighborhood demise.

For these communities going through severe monetary insecurity, even a small shock may have vital and wide-ranging implications.

If we borrow from the literature on resilience, we’d say that monetary insecurity is a measure of the power of people, households and communities to have the ability to face up to shocks and bounce again.

Invoice and I at the moment have a big Australian Analysis Council grant which is trying on the resilience of areas to bounce again resulting from financial shocks.

An index of monetary insecurity provides a smaller-scale element to that work.

The extent of resilience by way of monetary safety is being examined in communities throughout the nation and ought to be an extra wake-up name for governments to do extra.

The spatial concentrations of monetary insecurity we’re uncovering ought to be particularly regarding.

Now we have pointed this out in a few of our different work:

1. Individuals, House and Place: a Multidimensional Evaluation of Unemployment in Metropolitan Labour Markets (printed in Geographical Analysis on January 28, 2010).

2. Blissful Individuals in Combined-up Locations: The Affiliation between the Diploma and Kind of Native Socioeconomic Combine and Expressions of Neighbourhood Satisfaction (printed in City Research on December 7, 2009).

–Self-assessed well being standing and neighborhood context (printed within the Journal of Prevention and Intervention within the Group on August 11, 2016).

The focus of drawback throughout huge elements of cities, cities or areas has a variety of knock-on results for individuals who stay there, which push many additional into the abyss of drawback.

Monetary insecurity makes this worse.

However issues appear to only hold getting in the identical route.

Now we have a central financial institution that has misplaced the plot about coping with inflation and we’ve got governments who’re unwilling to introduce significant, sustainable measures to take care of the pressures on households and households.

The federal government and others seem unwilling to just accept that their selections are more likely to additional drawback already struggling communities and threaten to plunge others into hardship.

They’ll solely speak about endeavor accountable measures to alleviate pressures on households, which appears to be code for giving little or no to those that are most in want.

Now we have mentioned this time and time once more.

Conclusion

Our most deprived deserve a greater go.

The federal government might do one thing significant.

One thing that might translate right into a simply and sustainable transition for our society and economic system.

As an alternative, they appear to take a seat on their palms and keep the established order.

Not good!

We are able to do higher!

That’s sufficient for immediately!

(c) Copyright 2023 William Mitchell. All Rights Reserved.

[ad_2]