[ad_1]

In 2018, revenues for the web gross sales web site, Craigslist, peaked at $1.03 billion after which started a speedy descent. It’s nonetheless a viable firm (2022 revenues have been $694m) but it surely suffers from a case of channel calcification. Craigslist hasn’t modified a lot of its performance because it began, and customers discover that different choices supply a a lot better expertise.

On October 4, 2016 (be aware the timing), Fb Market hit the scene. Regardless that Fb itself is in decline, its offshoots similar to Market and Instagram are thriving. Market is probably Craigslist’s most related competitor because it permits customers to go looking and purchase regionally with ease. eBay, one other competitor, does much less native enterprise, however eBay sellers profit from built-in transport choices that make it simpler for patrons and sellers. And most lately is Etsy, the place sellers can supply high-quality, artisanal merchandise and developed a tremendous loyal buyer base with an estimated 40% are gross sales from repeat patrons. I do know I’ve purchased from all of those relying on what I’m in search of – I’m a multi-channel purchaser.

Fb Market has some clear benefits over Craigslist, most having to do with the shopper expertise. First, there’s safety. Consumers and sellers can see one another and work together much more simply, eradicating a number of the buy’s uncertainty. They’ll touch upon one another on the platform, which makes each events chargeable for finishing an excellent and truthful transaction. The vendor dashboard is straightforward to make use of. Cost may be made by the platform if each events comply with it with a number of completely different cost choices. Sellers also can pay a premium to get “pushed” to the highest of the listings.

So, the Craigslist downturn has two parts to it: Lack of buyer expertise enhancements and lack of vendor desire. If sellers discover that they’re promoting extra by a greater channel, they’ll transfer. Consumers will then transfer with them as a result of the choice improves by the brand new channel.

There are a dozen classes on this state of affairs for insurers, however let’s look intently at 5.

Lesson 1: Channels aren’t mounted. They’re fluid.

Most insurers grasp that they should create an ecosystem of interconnected channels, utilizing a spread of capabilities that may join with prospects when and the way they wish to purchase. Channel improvement and use is a balancing act. Channel effectiveness is at all times in movement. Insurers have to ask themselves, “Are we treating our channels as if they’re mounted in time or are we making ready to make use of at this time’s trending channels at this time and tomorrow’s trending channels tomorrow.” Not solely are channels not mounted in place, however an insurer’s channel technique must be constructed to stream with channel developments. The way in which to maintain up with buyer demand is to grow to be adept at broad distribution strategies and nice experiences. That is the place tech is available in. Lots of Majesco prospects are re-creating their digital distribution atmosphere utilizing our distribution administration options and ecosystem of companions.

In a press launch asserting our expanded capabilities, Karlyn Carnahan, head of Celent’s North American Insurance coverage observe acknowledged, “If a service desires to completely exploit the potential of its varied channels, they have to assume very in another way about distribution administration, compensation, and segmentation. Distribution administration platforms should proceed to evolve to allow insurers to handle their distribution drive with rising sophistication.”

Lesson 2: It’s essential for insurers to grasp trending channel preferences.

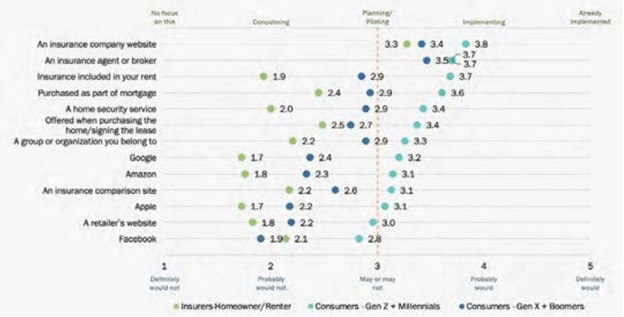

In Majesco’s current thought-leadership report, Bridging the Buyer Expectation Hole: Property Insurance coverage, we glance intently at buyer buy channel preferences weighed towards insurance policy for channel improvement. Do they match up? Once we visualize the info, the gaps are simple to see.

Conventional channels stay the popular technique for buying home-owner/renter insurance coverage, together with brokers/brokers and firm web sites, as mirrored in Determine 1. Nevertheless, for all the opposite channels, prospects’ curiosity is sort of twice that of insurers’ actions, significantly for the Gen Z and Millennial phase.

Determine 1: Buyer-Insurer gaps in distribution channels for private property insurance coverage.

The youthful era displays the need for entry by and all channels. Members of this era are heavy renters, and they’re starting their transition to homeownership. Insurers who’re providing ease of entry to renters’ insurance coverage have the chance to construct robust buyer relationships that may generate higher income. The digital expectations and ease of entry are high priorities for this era.

Insurers that wish to seize extra enterprise by a broad-channel strategy will take note of the bigger gaps and developments as they search for alternatives. Nevertheless, they may even wish to take note of these areas the place insurers appear to be getting nearer, however maybe their firm continues to be within the consideration part. This can be a signal that opponents could also be beating them to profitable partnerships. For instance, there’s a lessening hole for the channels, buying property insurance coverage on the level of a house buy or bought as part of a mortgage. These partnerships could also be rising in frequency.

Lesson 3: Life and enterprise occur on the level of buy and vice versa.

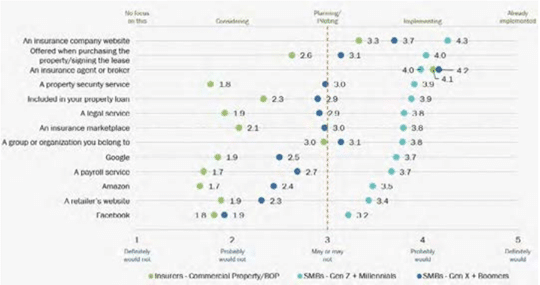

Fb Market had one distinct benefit over Craigslist proper from the outset — it was positioned the place individuals have been interacting, even after they weren’t searching for something. When Majesco survey information, it’s clear that SMB business property insurance coverage purchases also can occur almost wherever there may be interplay or engagement. Insurers must be asking themselves, “The place can’t we promote?”

Each generational SMB segments are inquisitive about all channels as proven in Determine 2. Nevertheless, insurers should not assembly these expectations, aside from brokers/brokers, and to some extent, firm web sites. The gaps are vital – as much as 2 occasions what insurers do – significantly for the youthful era of Gen Z and Millennials, in line with their expectations for a multi-channel world.

These gaps restrict insurers’ attain and development whereas placing them in a aggressive gap as in comparison with others which can be utilizing a multi-channel technique. Whereas brokers will proceed to be essential, easy accessibility to insurance coverage by way of different channels, significantly for embedded insurance coverage, shall be more and more essential for future viability.

Determine 2: Buyer-insurer gaps in distribution channels for business property insurance coverage.

For instance, in Determine 2, have a look at the hole between Gen Z/Millennial SMB’s curiosity inpurchasing property insurance coverage by their payroll service and insurers’ curiosity in offering property insurance coverage by the payroll channel.

For an SMB proprietor, there may be virtually no enterprise associate that’s consulted extra constantly than the payroll firm. Payroll contact occurs weekly or bi-weekly. Industrial property insurers would do nicely to associate with payroll firms. It’s a win/win. It makes a wonderful instance of the factors insurers ought to think about when they’re eager to broaden their distribution. Search for locations the place life and enterprise occur and people are the factors the place publicity may be fruitful. Payroll is a degree of buy.

Insurers can search for spots the place life and enterprise are occurring, even when there will not be a particular buy concerned. Examples of those could be commerce associations, neighborhood enterprise associations, authorized providers, upkeep suppliers, or safety providers. Definitely, one of many biggest relationship synergies must be between property insurers and property safety firms, but this distribution channel additionally has one of many largest gaps.

Lesson #4: Don’t assume you’ll be able to wait till tomorrow for channel enlargement.

The time is now for speedy multi-channel enlargement, enabled by applied sciences that may deal with the rising tempo of change. Some channels might not pan out. Some channels will pull their weight. Some shall be profitable. Like investing in mutual funds as an alternative of particular person shares, insurance coverage expertise investments want to permit for a broad strategy to distribution.

Change is quicker, deeper, wider, and extra highly effective than we’ve ever been used to earlier than. The end result? Rising buyer expectation gaps, significantly for the youthful era who are actually the dominant patrons put insurers liable to shedding loyalty and stifling development.

Ahead-thinking leaders are making daring, warp-speed strikes to shut buyer expectation gaps and place themselves for market management and development. They’re specializing in prolonged market and buyer attain for individuals and companies by new distribution channel choices, together with embedded insurance coverage. These choices meet individuals the place they’re at this time, not the place they are going to be subsequent 12 months.

For insurers, adopting a brand new distribution channel philosophy will give them a stronger, extra aggressive market place by a rising channel ecosystem that performs to their strengths and closes gaps or weaknesses.

Lesson #5: It isn’t sufficient to supply a brand new channel. You need to lend one thing new and improved to the expertise.

Partnerships and fashionable distribution expertise are two items of the identical puzzle. In at this time’s insurance coverage, you’ll be able to’t have one with out the opposite. Trendy distribution administration isn’t nearly connections — it’s about utilizing information, channel expertise, and channel efficiency to tweak, flex, and generate gross sales. Good digital experiences occur when the appropriate applied sciences are used creatively.

Majesco’s Distribution Administration and Digital360[DG1] options assist insurers fast-forward their channel enlargement plans, whereas immediately giving them the cutting-edge AI and machine studying instruments to adapt and develop. Insurers ought to ask themselves questions like, “Can we use our information to anticipate subsequent steps or anticipate further wants? Is our distribution administration feeding us insights that may assist us shift in a well timed method?”

Staying on the entrance of the aggressive pack takes an open perspective and a willingness to repeatedly adapt. “The place can’t we promote?” The reply is, “Solely the place we aren’t ready to.”

It could be arduous to imagine, however Craigslist was as soon as “cutting-edge” and disruptive. It actually shares a number of the credit score for hastening the demise of some day by day print newspapers. But, plainly it was by no means Craigslist’s aim to grow to be way more than it already was.

Insurers should be completely different. Leaders that want to stay on high of the competitors will hold distribution expertise on the forefront of their priorities. They may even return incessantly to their distribution technique and assess its alignment with particular person and enterprise buyer channel developments.

For a more in-depth have a look at how some insurers are aligning themselves to P&C prospects, you’ll want to learn Majesco’s thought-leadership report, Bridging the Buyer Expectation Hole: Property Insurance coverage. For extra info on how at this time’s tech will help to broaden your organization’s distribution channels, contact Majesco at this time.

[DG1]hyperlink

[ad_2]